Understanding your landlord statement

We know that the end of the month can sometimes be stressful, so we’ve created a quick guide to help explain your landlord statement. Your statement outlines the rent received, any deductions, payments made to you and your remaining balance. Understanding each section can help you stay on top of your property finances.

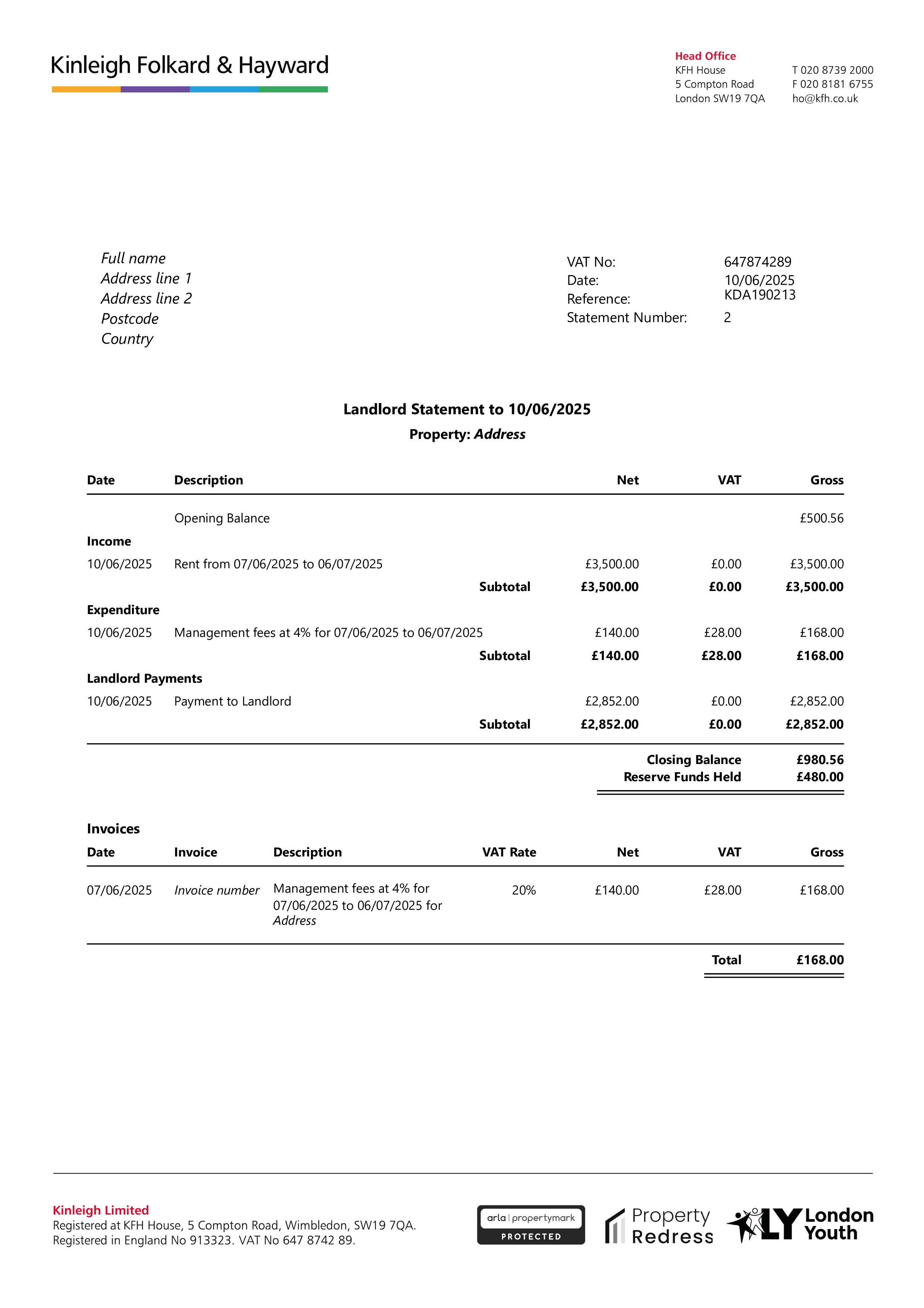

Statement number

This is a unique reference used to identify your landlord account. It helps us locate your details quickly and track your statements over time.

Opening balance

The amount carried forward from your previous statement. This reflects the balance in your account at the start of the current period.

Subtotal

Shows the total income received during the statement period. Each entry includes a description explaining the source of the income.

Expenditure

Lists any deductions such as management fees, supplier invoices, or withheld tax. These are subtracted from your income.

Landlord payments

The total amount paid into your bank account during the statement period.

Closing balance

The remaining balance in your account at the end of the statement. This may include interest earned, funds held for upcoming works, or float retained.

Invoices

This section displays all invoices raised against your account. This section provides invoice numbers and details to support your own accounting and matches entries in the payments section.

If you have any further questions about your statement, please contact the Client Accounts team at lca@kfh.co.uk.